What is Cost Segregation?

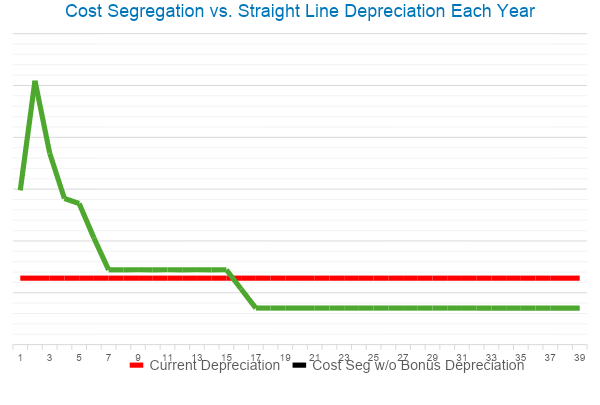

Cost Segregation is an IRS-approved tax planning strategy that improves cash flow through accelerated depreciation deductions on investment properties, owner-occupied properties, and tenant improvements. Simply put, it defers taxes. Cost Segregation may almost be thought of as an interest-free loan that is paid off over the life of the property.

Cost Segregation frees up capital by accelerating the depreciation of personal property (§ 1245) and Qualified Improvement Property (QIP) as well as identifying various expensing opportunities associated with commercial real estate. The accelerated time frame of qualifying property is typically 5, 7, and 15 years rather than the straight-line 27.5 or 39 years for the building itself (§1250).

The benefits include:

- Reduces short-term tax liability

- Increases short-term cashflow

- Time value of money

- Coordination with other tax credits such as solar and geothermal

Who May Benefit from Cost Segregation?

Cost Segregation is one of the most common tax strategies for owners of commercial and residential real estate. Studies may be performed on virtually any property type. If you haven’t done so already, reach out to discuss the strategy with your tax advisor and a Cost Segregation professional to determine whether Cost Segregation is right for you.

Cost Segregation may apply whenever you place property into service through:

- Acquisition

- New construction

- Renovation

There are a few simple guidelines to look out for:

- Owe federal income tax – Cost Segregation is a tax strategy that defers federal income tax. If a property owner does not pay federal income tax, Cost Segregation is probably not the right strategy for you.

- Holding on to the property – Cost Segregation generally makes sense if you are planning on holding onto the property for at least 5 – 7 years. If you plan on flipping the property, any taxes owed will become due in an event called recapture. As with any discussion of Cost Segregation, there are exceptions to the rule and there are ways of mitigating recapture.

- Placed in service in the last 5 – 7 years – Most Cost Segregation studies are performed within a year or so of placing property into service. However, if a study was not conducted at that time, you may still perform a lookback study. A catch up in missed depreciation is allowed. A general guideline is that a study may look back 5 – 7 years.

- At least $500,000 in capitalized costs – The benefits of Cost Segregation are commensurate with the value of the property. Small properties generally don’t generate enough benefit to justify the cost of a study.

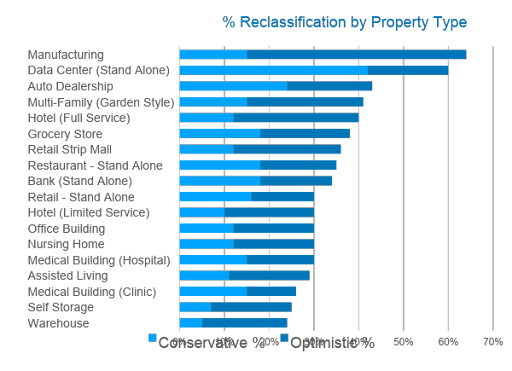

While almost any property type may benefit from Cost Segregation, some benefit more than others. Complex properties such as data centers are full of personal property while, at the other end of the scale, warehouses have very little personal property associated with them. Some of the factors affecting the potential benefits include:

- Business activity

- Complexity of the property’s technology

- Quality of the finishes used

- Site improvements surrounding the property

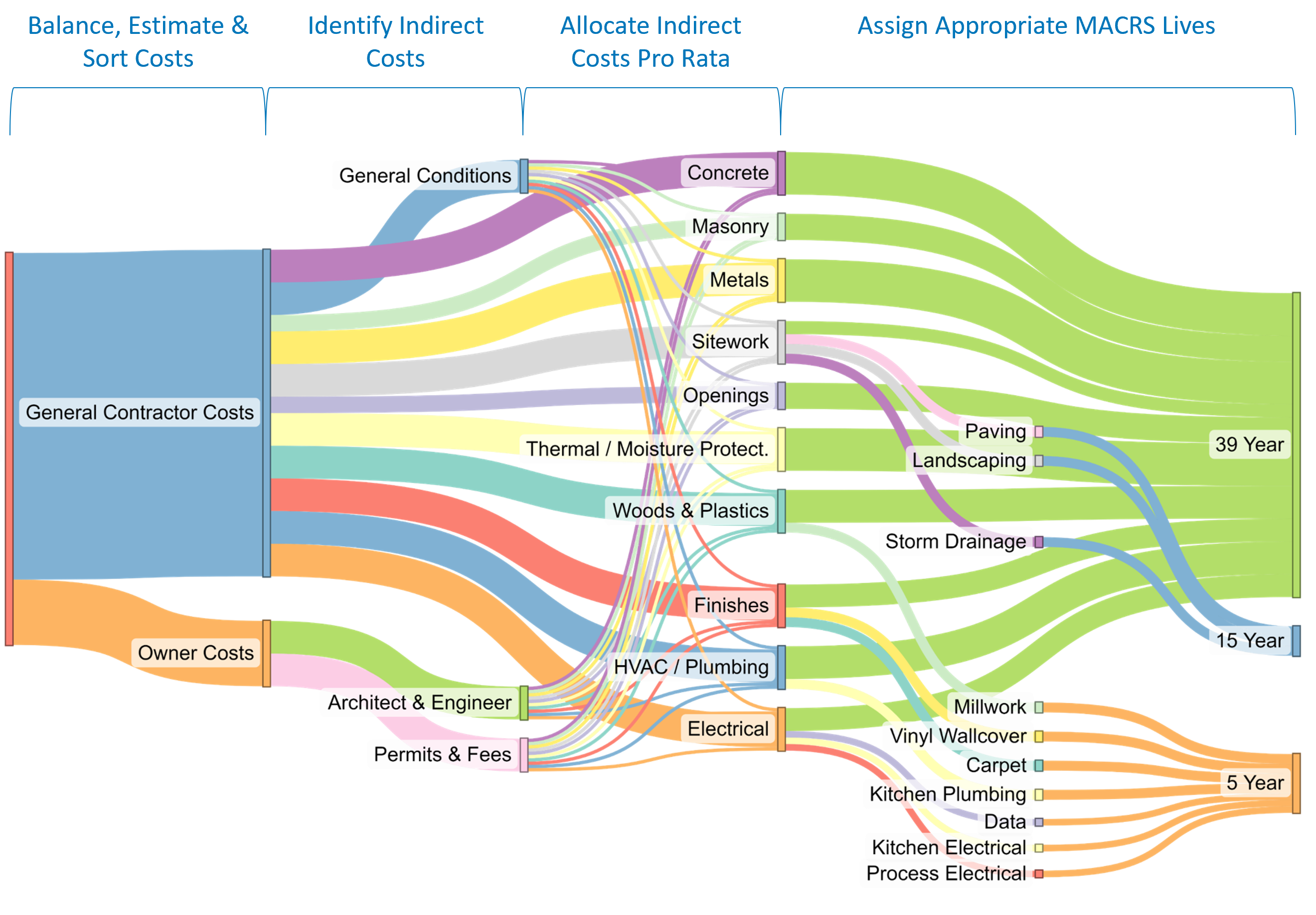

Blue Energy Group’s Cost Segregation Process

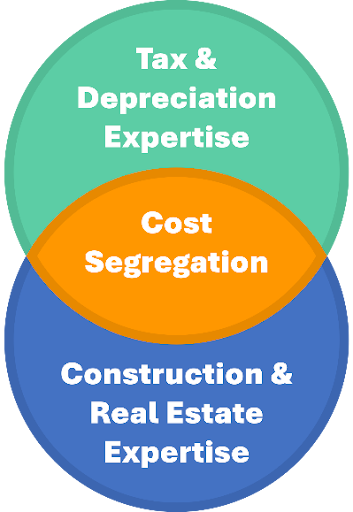

Cost Segregation is a complex methodology that leans heavily on construction, tax, and depreciation expertise in the form of architects, engineers, and CPAs. All projects are unique, but a general outline of the process is as follows:

- Scoping – Defines the nature of an engagement and generates an estimate of the potential benefits. This

includes the identification of Cost Segregation adjacent opportunities such as:

a. § 179 expensing

b. § 179D expensing

c. Dispositions expensing

d. Repairs expensing

e. Energy tax credits such as solar or geothermal - Data requests – Gather information about the property such as construction costs, drawings, depreciation schedules, appraisals, etc. This process may include relevant interviews.

- Review available data – Review available construction costs and drawings to identify qualifying property.

- Estimates – Perform detailed estimates if actual costs are unavailable or to supplement those that are. Nationally recognized cost sources, such as RSMeans, are utilized.

- Site visit – Conduct a site visit to verify assumptions and, if necessary, perform field estimates. Many companies skip this very important step but it is not only expected by the IRS but necessary to verify assumptions and perform accurate estimates.

- Indirect Costs – Allocate indirect costs to relevant § 1250 and § 1245 property. Indirect costs may be allocated at three levels of specificity including;

a. Division or trade indirects such as landscape design,

b. Contractor specific indirects such as their overhead and profit, and

c. Project indirects such as general architecture and engineering costs. - Generate the report – Compile detailed schedules of all costs along with their respective MACRS class lives in compliance with IRS guidelines for a quality study as defined in the Cost Segregation Audit Techniques Guide.

- Map to depreciation schedule

- Issue the report

Differentiators

- In-house expertise – Our in-house team of engineers, architects, and CPAs has comprehensive knowledge in cost segregation as well as other energy related tax incentives affecting real estate. Because we do not offshore any aspect of our studies, you always have direct access to our professionals.

- Audit Experience – Our team has decades of combined experience successfully defending our studies under audit.

- Tailored Solutions – We all know that one size does NOT fit all.

- Recognized for our Experience – Our team are regularly invited to present continuing professional education (CPE) courses and have presented them before many professional organizations including the AICPA.

- Site Visits – In accordance with IRS recommendations, we visit virtually every building we study. This ensures a thorough understanding of the facility, identifies personal property not reflected in the drawings and reduces unexpected surprises. In cost segregation, site visits should be an expectation and not optional.

- We Show Our Homework – Our studies are designed to stand up to IRS scrutiny. As such, we “show our homework”. Each step of our calculations is shown and is easy to understand.

- Professional Scoping – Projects are scoped by a professional with decades of experience in cost segregation. Since no two projects are alike, and cost segregation can be quite complicated, we take our responsibility to properly scope your unique situation very seriously.