179D Defined

The Energy Policy Act of 2005 created a tax deduction for energy efficient buildings found in Section 179D of the Federal Tax Code. Section 179D provides a tax deduction for energy efficiency improvements to commercial buildings. A building may qualify for a tax deduction under Section 179D for as much as $5.00 per square foot. An energy efficient envelope, heating, ventilating, and air conditioning (HVAC) system, or lighting system can qualify for the 179D tax deduction. Energy simulations are required to show compliance with the energy and power cost savings requirements.

Who can claim the 179D deduction?

There are two groups of candidates eligible to claim the 179D tax deduction:

- Architects, engineers, ESCOs, and designers of energy efficient municipal building projects

- Private owners of energy efficient commercial properties

Private owners of commercial properties that were newly constructed or retrofitted since 12/31/2005 are eligible for the 179D tax deduction. In addition to privately owned buildings, a provision was made in 2008 to allow municipal buildings to benefit from 179D. Since municipal buildings are owned by a non-tax-paying public entity, the municipality can allocate their 179D tax deduction to the designer of the energy efficient system such as an architect, engineer, or ESCO.

Qualified Individual

A qualified individual is required to perform a modeling analysis on the building, conduct a site visit, and provide a certificate of compliance to the tax payer. According to the IRS, a qualified individual is (1) not related to the taxpayer (within the meaning of Section 45(e)(4), (2) is an engineer or contractor that is properly licensed as a professional engineer or contractor, and (3) has represented in writing to the taxpayer that he has the requisite qualifications. In other words, an independent third party who meets the above criteria is required to perform the study.

Deduction Amount

The 179D deduction is calculated based on the energy efficiency of the commercial building, as compared to an ASHRAE 90.1-2007 baseline building. This baseline will be in place through tax year 2026. For new buildings and renovations placed into service in tax year 2023 and beyond, there is only one viable compliance pathway to qualify for 179D and that is via a whole building energy model.

Beginning in 2023, the 179D deduction ranges from $0.50/sf to $1.00/sf. The amount of the deduction is directly related to the energy savings predicted in the energy model analysis. This is a sliding scale from 25% energy savings to 50% energy savings correlating to the $0.50/sf minimum and $1.00/sf maximum. However, if the project meets the prevailing wage and apprenticeship requirements outlined in the Inflation Reduction Act or construction can be shown to have begun prior to January 29, 2003, then there is a 5x multiplier increasing the deduction range to $2.50/sf minimum and $5.00/sf maximum.

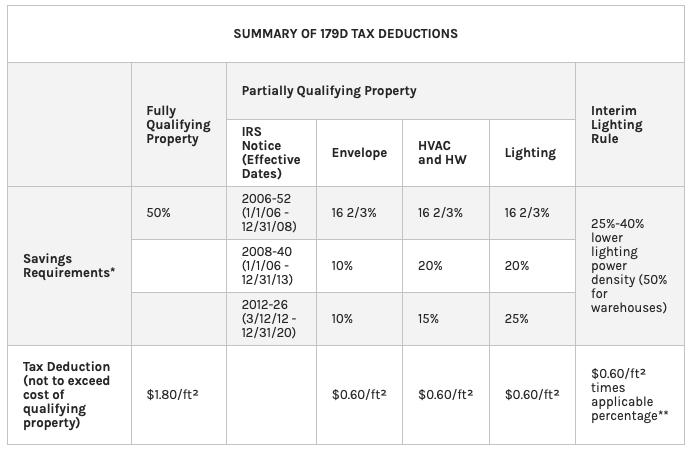

For tax years 2022 and earlier, there are three compliance pathways to qualify for the 179D federal tax deduction:

- Whole building qualification with 50% energy and power cost savings shown through energy modeling.

- Partial qualification for envelope, HVAC, and lighting with energy and power cost savings shown through energy modeling with threshold options (see chart below).

- Partial qualification for lighting through the interim lighting rule based on reductions in installed lighting power.

* Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, and HW systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 90.1-2001 for buildings placed in service prior to 1/1/2016 and ASHRAE Standard 90.1-2007 for buildings placed in service on or after 1/1/2016.

** The tax deduction is prorated depending on the reduction in LPD. See IRS Notice 2006-52 for the definition of “applicable percentage.”

Benefit

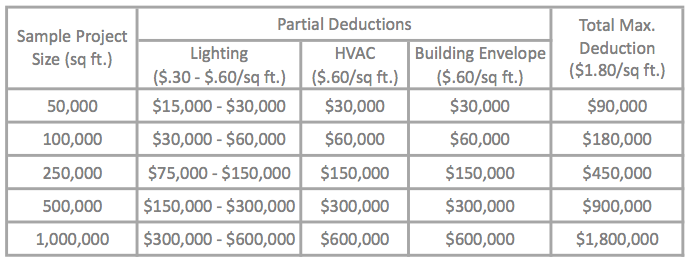

Ideal candidates for EPAct deductions are newly constructed buildings and renovation projects with at least 30,000 square feet. The following chart shows some examples of the 179D deduction amount you might expect to receive based on building size.