Services

179D Tax Deductions

The Energy Policy Act of 2005 created a tax deduction for energy efficient buildings found in Section 179D of the Federal Tax Code. Section 179D provides a tax deduction for energy efficiency improvements to commercial buildings. A building may qualify for a tax deduction under Section 179D for as much as $5.00 per square foot for owners and designers.

IRA Tax Credits

Our team specializes in helping building owners secure their Investment Tax Credits (ITC). The Inflation Reduction Act (IRA) created dozens of renewable energy tax credits including the ability for public and non-profit building owners to receive these credit in a direct payment. Allow us to partner with you to maximize these credits.

Cost Segregation Studies

Our in-house team of engineers, architects, and CPAs has comprehensive knowledge in cost segregation. We help building owners improve cash flow through accelerated depreciation deductions on investment properties, owner-occupied properties, and tenant improvements. The Blue Energy team has decades of experience producing tailored studies and successfully defending our studies under audit.

45L Tax Credits (Energy Star Certifications)

The IRA extended and increased the Section 45L tax credit for homebuilders and developers of energy efficient homes, condos and apartment units. The available tax credit ranges from $500 to $5000 per unit and must be certified for Energy Star. This is a complicated tax credit that our team can help you navigate.

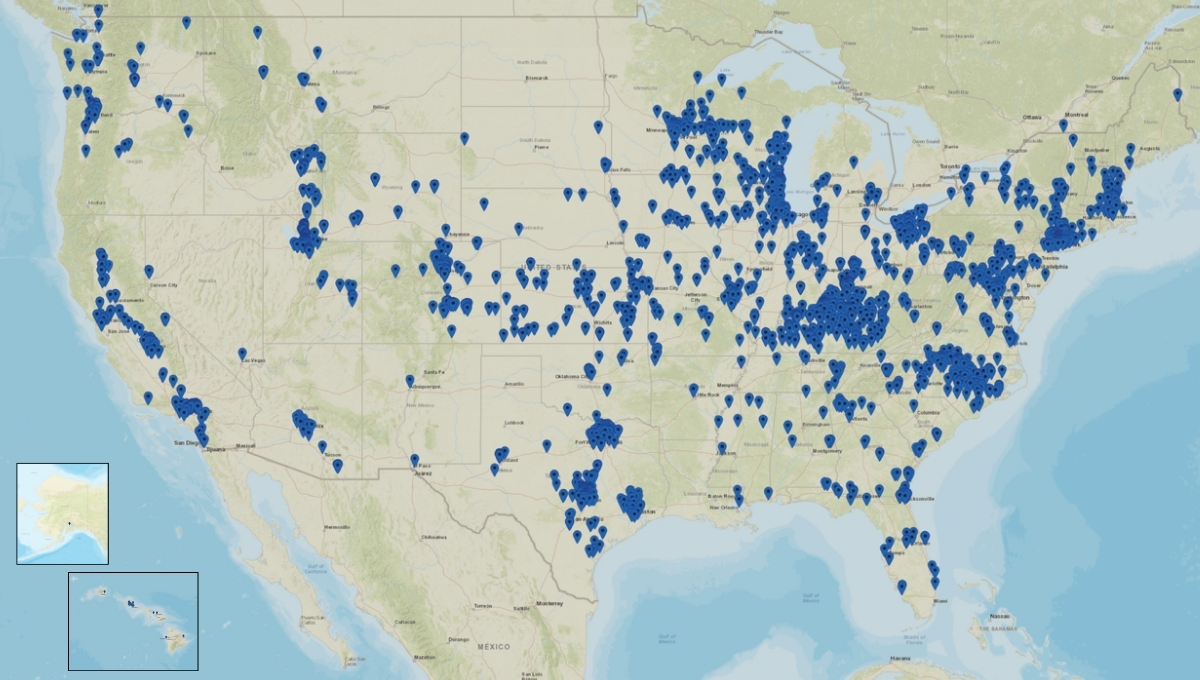

Connect With Us At An Industry Event

Our Work

Blue Energy Group has never lost an audit.

We have partnered with accounting firms, design build firms,

and building owners for over a decade. If there is a tax incentive out there

for your building to be efficient, we can help.